Explain Different Types of Bill of Exchange

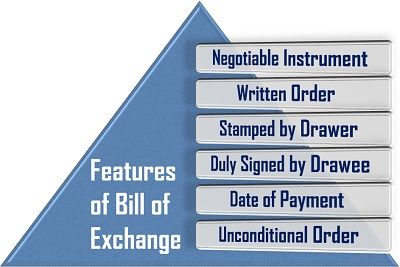

Types and Classification of Bill of Exchange. Bill of exchange is a negotiable instrument which is payable either to order or to the bearer.

How Auto Insurance Company Works And How To Lower Your Auto Insurance Bill Umbrella Insurance Car Insurance Insurance Company

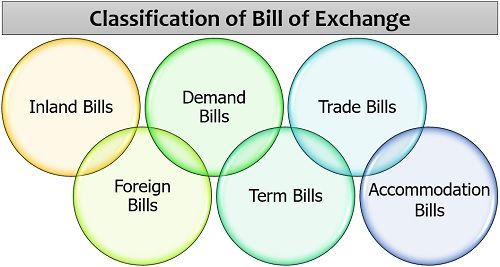

Types of Bill of Exchange on the Basis of Period.

. There are three types of a negotiable instrument as per statute ie. The person who is in possession of a bill of exchange. A bill which is payable on demand or when presented are at the site is called a demand bill.

A bill of exchange issued by individuals is. Inland bill means the bill which is drawn and payable within the same country. Bills may be of the following types.

These types of bills are payable on demand and the drawee has to pay the amount when the bill is presented to him for payment. When the bank of exchange is generated or issued by the bank it is termed a bank draft. Discounting of a Bill of Exchange.

There are various commercial risks which the exporter must take into account. It is the party who sells the goods issues the bill of exchange and is yet to receive the money from the debtor. Demand bills do not have a fixed date associated with them.

There is no fixed date for the payment of such bill. The person who endorses a bill of exchange. TYPES OF BILLS OF EXCHANGE.

This is also termed as time bill. Tem Bills of Exchange. Here is the list of types of bills of exchange.

A bill of exchange is governed by the. On the basis of period bills are of two types. Now that you have a better understanding of what a BOE is here is a breakdown of the various types of bills of exchange.

B finance bills or promissory notes. Bill of Exchange Sent to Bank for Collection. A bill is a promise to pay a specified amount by the borrower drawer to the creditor drawee.

The most common type of bill of exchange is the cheque which is drawn on a banker and it is payable on demand. The person in whose favor the bill of exchange is endorsed and who receives it after endorsement. They are payable at any.

There are many instances when people juxtapose cheque for a bill of exchange but they are different in the sense that a bill of exchange requires acceptance whereas there is no need for acceptance in cheque. These are as follows. What Are the Various Types of Bills of Exchange.

They become payable at ay time when they are presented before payee by the holder. Cheque bills of exchange and promissory note. Different types of bill of exchange.

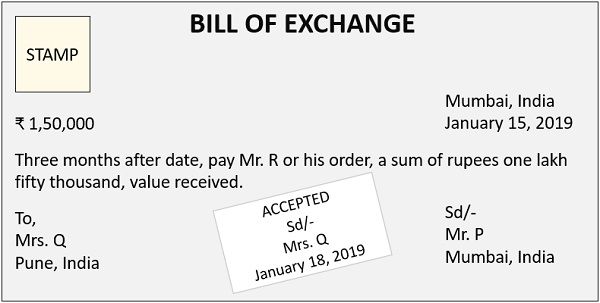

Bill of exchange means a bill drawn by a person directing another person to pay the specified sum of money to another person. Renewal of Bill of Exchange. A bill of exchange is of real use if it is accepted by the person directed to pay the amount.

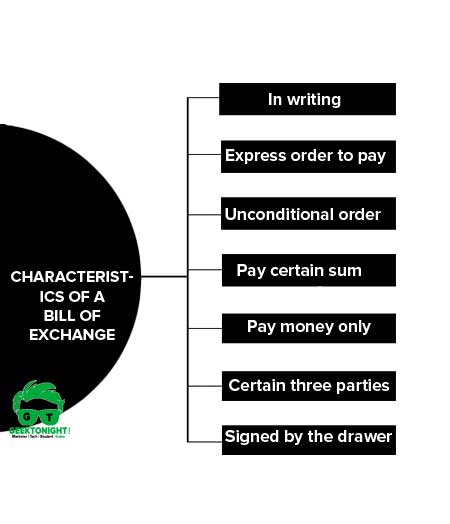

2 Demand bill. As shown in the above image Bills of Exchange are normally of two types. The instrument is addressed to the buyer.

The buyer must pay the Seller on demand a sight draft or at a fixed determinable time in the future also called time. Different Types Of Bill Of Exchange. Negotiation means transferring of an instrument from one person to another in such a manner as to convey title and to make the transferee the.

The Seller of goods who writes the Bills of Exchange. Kane Dane A negotiable instrument may be transferred either by negotiation or by assignment. Documentary bill of exchange Such a bill is validated with specific documents that affirm the trade transaction.

Section 13 1 of the Negotiable Instruments Act 1881 defines negotiable instruments as A promissory note bill of exchange or cheque payable either to order or to bearer. The Cheque is the document which contains an order to the bank to pay a certain amount of money from the account of the customer. The issuing bank guarantees payment on the transaction.

And c treasury bills used. Dishonor of Bill of Exchange. It is the party who purchases the goods on credit and to whom the bill of exchange is issued.

Types of Bills of Exchange. Documents against payment - The payment must be made to the bank when the buyer is presented with the draft and before. The different parts of the Bills of Exchange are.

When the individual issues the bill it is known as trade draft. Based on the requirement and mode of payment different types of bills of exchange are used. A bill of exchange can be defined as a legal document which contains the information about the future payment from the person who is required to pay money and on the name of the person who is entitled to receive money.

3 Usance bill. Documents against acceptance - The. Because there is no set payment date for the bill it must be cleared whenever it is delivered.

This draft is written by the drawer to the drawee. What is an endorsement in relation to a bill of exchange. A bill of exchange is generally drawn by the creditor on his debtor.

Bills are of three types- a bills of exchange or commercial bills used to finance trade. A bill of exchange issued by a bank is referred to as a bank draft. For example X orders Y to pay 50000 for 90 days after date and Y accepts this order by signing his name then it will be.

Insolvency of One Party. Explain the various types of such endorsements. The Bill of Exchange is the document which contains an order to drawee to pay a certain amount to the payee on demand or after certain time period.

Documentary Bill-The Bill of Exchange is accompanied by the required documentation that attests to the validity of the sale or transaction between the seller and the buyer. A BoE which is always accompanied by supporting documents which confirm the. He is also called the holder.

Thus the bill which is drawn in Pakistan and will also be paid in Pakistan is termed as. Retiring a Bill of Exchange Under Rebate. Types of BoE 1 Documentary bill of exchange.

Accounting Treatment of Bill of Exchange. Endorsement of Bill of Exchange. The bearer and the payee is usually the same person.

Bills of exchange can be based on period as demand bills and term bills. The major feature of bills of exchange is that it is used in the international trade. A bill of exchange is a written order to pay money to the payee.

Demand Bills of Exchange. Bills of Exchange Payable at Sight. Both the types of bill DA and DP are common in international trade.

These drafts are in written form. Basically drawee is the debtor and the drawer is. A bill of exchange is often used in business transactions and national and international trades.

Demand Bill - It is a bill that must be paid when it is demanded.

Types Of Endorsement Type Meant To Be Business Law

Bill Of Lading Explained The Complete Beginner S Guide

Bill Of Exchange Vs Promissory Note Difference And Comparison The Investors Book

Bill Of Exchange Meaning Definition Types Format Importance

Letter Of Credit Mechanism Process Money Management Advice Finance Investing Budgeting Finances

What You Can Learn From Bill Gates About Traffic Exchange Dollar Followyourheart Likefo Social Media Traffic Social Networking Sites Social Media Statistics

Perfect Difference Between Authority And Responsibility With Table No Response Author Define Success

Packing Declaration Document Template Used For Import Export Stock Market Document Templates How To Find Out

The Five Types Of Adr An Explanation Of The Different Types Of Alternative Dispute Reso Alternative Dispute Resolution Conflict Resolution Resolving Conflict

Printable Sample Business Proposal Template Form Business Proposal Template Business Proposal Business Proposal Letter

Bill Of Exchange Vs Promissory Note Difference And Comparison The Investors Book

Printable Sample Bill Of Sale Form Bill Of Sale Template Real Estate Forms Sample Resume

Bill Of Exchange 11 Types Of Boe Explained With Meanings Examples

Bill Of Exchange Vs Promissory Note Difference And Comparison The Investors Book

What Is A Bank And Different Types Of Banks In 2022 Financial Management Bank Financial Retail Banking

/bill-of-exchange-55bea739977f49c2897cd068b609b956.jpg)

/bill-of-exchange-55bea739977f49c2897cd068b609b956.jpg)

Comments

Post a Comment